One should not react to a mosquito bite by scratching the wound. In the fight for malaria eradication, world renowned-economist Jeffrey Sachs advocates for technocratic solutions. This investigative piece evaluates the specific barriers and policy solutions encountered and employed by international actors, namely household data collection and analysis methodologies for malarial net distribution and cash-transfers to provide basic income to individuals in extreme poverty.

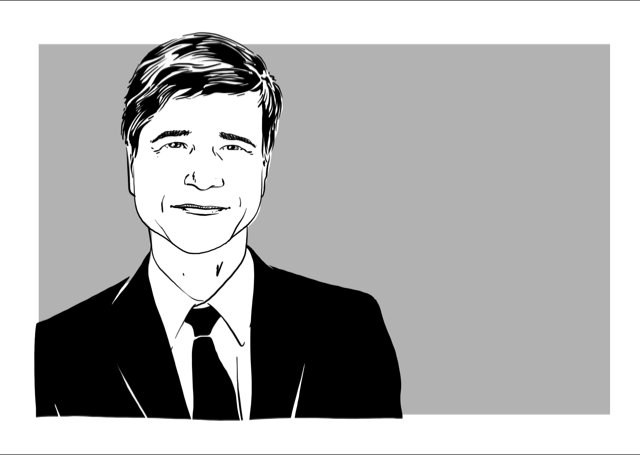

This article is the first part of a series featuring an interview with one of the most world-renowned development economists of the 21st century, Jeffrey D. Sachs, conducted by the Editor-in-Chief of The Governance Post, Mahima Shah Verma, following his Kapuscinski Development Lecture on the Sustainable Development Goals (SDGs) at the Hertie School on October 7, 2019.

Jeffrey D. Sachs is the Director of the United Nations Sustainable Solutions Network under UN Secretary General António Guterres and is a Professor at Columbia University in New York. Sachs served as the director of the Millennium Development Goals – the predecessor to the SDGs – under former UN Secretary General Ban Ki-Moon.

The series presents the first part of a conversation between Sachs and Shah Verma concerning the European Commission’s external policymaking for sustainability and economic development under its new chief and former German Defence Minister, Ursula von der Leyen. The conversation is followed by an investigation into the roots of and solutions to economic dependence created by foreign development aid for malaria eradication in ‘developing countries’, namely on the African continent. This investigative piece is based on interviews she conducted with European climate and political economy experts at the Hertie School, the founding CEOs of world-renowned organisations, Against Malaria Foundation and GiveDirectly, and a former advisor to UN Secretary General Kofi Annan.

Since the fall of the Iron Curtain, ‘foreign aid’ has been a misnomer for the promotion of human rights and democracy. ‘Aid’ is a buzzword for repressed economic growth suffered by those cast off as ‘least developed’ countries. So, why should this technical word be used by policymakers to cast a wider net over several forms of bilateral and multilateral giving designed to counter global poverty when its logic often perpetuates a game of self-interest by aid agencies and governments everywhere?

Jeffrey D. Sachs sat down with me, after his Kapuscinski Development Lecture, to share his thoughts about the problems of sustainability that the European Union is facing in the new decade, where instability is given for the divided union. His solution for the challenges in the new European Commission’s (EC) policymaking for foreign development aid and carbon neutrality in the EU? Technocracy.

“Poor countries should not be dependent on foreign development assistance if they are to enable their citizens to meet basic needs,” says Sachs. “That is a matter of the harsh arithmetic of poverty. The ultimate answer to dependence is economic development. Countries graduate from the need when they are able to train their workforces, educate their children, and keep people healthy, and thereby benefit from economic growth. The structure of this aid is a matter of expertise.”

Questioning the “harsh arithmetic of poverty” Sachs and other sustainable development practitioners use to evaluate the governance capabilities of ‘poor countries’ led me to a single, deadly human issue: malaria. To evaluate how economic theories of poverty and development affect the actions of humanitarian assistance taken by practitioners on the ground, I conducted interviews with three policy experts in Berlin, practitioners operating global human assistance from their bases in London and San Diego, and a former advisor to UN Secretary-General Kofi Annan on the Africa Progress Panel. On this first trail of breadcrumbs, I encountered the wrongly-named culprit caught in the net of sustainable development policymaking based on foreign aid: the mosquito.

Malaria is a symptom of another disease entirely: the ecological, environmental and public health factors in which mosquitoes thrive. While the lifecycle of the infected mosquito host completes in 48 hours and incubates in the bitten human host a week later, the itchy scratch thrives in the human needs to control, eliminate, and eradicate the breeding mosquito. Policymakers, doctors, and humanitarians have altogether pigeonholed themselves into these very three words of action: control: reducing the frequency of the disease; eliminate: stopping its spread in a defined territory; and eradicate: completely annihilating it by removing its biochemical bases. Interpretation is a matter of life or death.

The highest mortality rates of malaria are found in Africa as a global consequence of this unspoken disease. The development economics calculus has wrongly cast the world’s largest continent in the international eye as incapable of self-governance and risky for investment and partnership for sustainable development since the 1960s. Cushioned by a net of billions of euros in research grants, science-driven malaria cures and preventatives on the current market include a variety of topical solutions with short-lasting shelf-life: insecticidal nets, tablets, vaccines, plastic tubes, and information pamphlets lining the walls of medical offices and international agencies that sell travel and humanitarian aid volunteer packages to the continent.

“Malaria is not a disease of poverty,” says Max Bankole Jarrett, who until December 2017 worked closely in Geneva with the former UN Secretary General Kofi Annan as the final Director-in-charge of the Africa Progress Panel, which Annan chaired for a decade from 2007. “Why did malaria get eradicated in America and European countries? These countries ‘transformed their bases’. They improved the living conditions of all by building transformative new public sanitation systems – by draining the swamp, so to speak. In my view, you are wasting billions on supplying nets alone if there is still stagnant water lying around.” Jarrett calls for the pan-African mobilisation of finance for green (agro) and blue (fishing) revolutions, significantly boosting funding for energy and transport sectors, and countering illicit financial flows in African governance structures – all as part of a vision to transform the economic base of the continent.

Some could cogently argue that EU policy in this field is a form of institutional “stagnant water” : bureaucratic shortsightedness and inaction. As the second largest donor globally for development assistance, the EU is now committing to Africa over 1.3 billion euros to specifically combat HIV/AIDs, malaria, and tuberculosis from 2014 to 2024. France, Britain, and Germany, the largest EU member state donors for development aid, have nominally increased their aid for countries with ‘cleaner’ records of human rights protections, democratic government, and former colonial ties, according to a study of European donors conducted between 1993 and 2003. While filtering its foreign aid on the basis of recipients’ human rights histories defined by criteria excluding governance in areas of limited statehood, the EC’s incentivisation of its so-called democratic infrastructures abroad through money for basic necessities is a growing part of the problem, not the solution.

Misinterpreted by the EC to be both caused by poverty and also a cause of poverty, malaria must be removed from its deoxygenated breeding grounds: the stagnant water of the development economics of poverty reduction. Defining ‘foreign development assistance’ is a question of the intentions and capacities of financing the stagnant water everywhere. For the purposes of our discussion, development aid is specific to non-emergency contexts and purposes (opposite of humanitarian aid), with a very specific branding for country governments based on the hierarchy of development: Official Development Assistance (ODA). Governments fund ODA using its taxpayer revenue and distribute it to recipient countries either via their own agencies (bilateral) or via international development banks, aid agencies, and UN bodies (multilateral). However, contrary to popular perception, it is only in the past three decades that humanitarian aid has increased 17 fold in sharp contrast to the almost three fold increase in ODA, which has traditionally been the primary source of all foreign aid. In response to a rapid increase in natural and man-made disasters, NGOs and the private sector and thus also humanitarian aid are now at the global frontlines of servicing long-term human need. Development aid – originally allocated for non-emergency contexts and purposes – has dangerously been repurposed to serve as the first, short term supply of oxygen for the most vulnerable of our communities.

The “arithmetic of poverty” Sachs refers to in regards to malaria is generated in large part by the Global Fund to Fight AIDS, Tuberculosis, and Malaria, which Sachs assisted the late Kofi Annan in creating in 200l, as his special adviser. Using a business model, the Global Fund reports that 93% of its funds are raised from donor governments to fund local, “expert-led” programmes that implement its malaria eradication approaches on the ground. Sachs’ logic of development stresses the heavy costs of curing malaria in certain countries entirely on the basis of their GDP, a problematic indicator that is an unreliable measure of poverty and production. Yet, rather than weighing in the benefits of creating tailored services that fuel a country’s existing healthcare facilities to structurally improve, this business model does little to institutionalise the long-term relationships between the patient, doctor, and medical service providers that are necessary for eradication not just of the disease, but also of such business models profiting from human vulnerability.

The “harsh arithmetic” of poverty has lost its backbone. In the aftermath of the 2008 global financial crisis, former World Bank Chief Stiglitz pointed out two key flaws of development economics: first, development policies are designed to be regressive; that is, the costs of implementation are spread unevenly across socio-economic groups and lead to contractionary monetary and fiscal policies, thus higher costs for the poor and higher unemployment and poverty during crises. Second, there is a lack of metrics to evaluate the impact of sustainable development on the wellbeing of a country’s people.

The distortion of economic realities and perceptions of international development money flows, that Jarret names a “challenge of perceptions,” began in the 1960s when Africa was strongly leading its counterparts China and India in economic growth and natural resource markets. The latter countries opened their doors to foreign investment under conservative communist and democractic governance in the 1980s and 1990s respectively. At the time, the story of African prosperity based on GDP predicted by economic analysts fell short of expectations at the turn of the century – these analysts covered up their tracks by wrongly blaming governance structures in Africa as incompetent rather than attributing the lack of growth due to the inadequacies of global fiscal and financial governance structures to address the more detrimental impacts of global monetary shocks experienced by already decapitated-economies in African countries that had been forcibly spoon-fed ‘civilisation’ for centuries. International cash flowing in, and subsequently, out of Africa are also two sides of the same coin of sustainable development.

In the field practice of malaria eradication, governments and aid agencies must deliver international aid through accountability and transparency through data. There is one critical type of indicator that determines allocation and efficiency: average household size. The Against Malaria Foundation (AMF) is one such nonprofit organisation that fills the local gaps of prevention-focused interventions for malaria victims. This nonprofit uses one tool: long-lasting insecticidal nets (LLINs).

AMF is a globally top-ranked charity, for demonstrating strong evidence in its model for reducing malaria-related child mortality through its distribution of free-of-charge LLINs, which cost them $2 to fund per 2 people covered. Based in a single home-office in London as a tax-deductible charity registered in 12 countries, CEO and Founder Rob Mathers and his seven-person team have implemented and monitor the on-the-ground distribution of almost 58 million LLINs across Africa to protect more than 100 million people. “Before a net distribution occurs,” Mathers explains, “all the households are registered to find out exactly how many nets each individual household needs to cover all members. Hired local data collectors, in collaboration with national health system staff, carry out the ‘registration phase’ of what is a national net distribution campaign, using cell phones and tablets to register data. They tell each other before they visit a house, so that someone else can recheck their counting during a random selection of 5% of the households; this establishes accuracy through a 105% re-registration process.”

While this rechecking process prevents people from falling through the figurative net, the literal net is blanketing the true dependencies of its recipients to external health service provision at subsistence levels. In the context of humanitarian aid, how can the incentivisation of a multi-faceted approach to development policy be done in an effective way that doesn’t encourage dependency?

Cash transfers are one popular policy solution, as seen in the steady increase of cash transfers and vouchers making up over 38% of the EU’s growing humanitarian assistance commitments since 2017 under the Grand Bargain. Cash transfers are far from being the perfect cure to dependency, but they are a starting point to empower recipient decision-making in conditions where the poorest 20 percent of countries composed only 1-5 percent of total humanitarian aid flows from 1960 to 2013. Cash transfers allow recipients to directly decide the uses and allocation of assistance for their benefit in their respective environments. It must be noted that actors in areas of limited statehood are also achieving the EU’s global humanitarian aid initiatives in the foreign aid arena; global nonprofits and private individual actors can bypass the checkboxes of the European Union External Action Development Cooperation.

The concept of a basic, or guaranteed income is one hotly contested, age-old policy that could shift the ‘us-versus-them’ mentality perpetuated by development economics and create a more democratic process of poverty reduction. The first and largest nonprofit in the world that has given millions in cash transfers to over 100,000 households living in extreme poverty, GiveDirectly, seeks to transform the economic base of villages by ensuring a person’s household budget is at basic subsistence levels on an annual basis via a cost-free electronic transfer to recipients using SMS and local mobile money agents.

“I view cash transfers as a governance issue: who gets to decide where the money is going and in what form?” asks Paul Niehaus, Founder of the Silicon-Valley venture. “Governments in these countries were already doing cash transfers on a large scale. When we started, we were in the last-mile payment space. We still face less social acceptance across our audiences, as many believe that poor people cannot make decisions for themselves. Foreign aid is spent on behalf of poor people, so accountability in this arena does not run through a general electoral process to give people a direct say in their spending. The World Humanitarian Summit’s Grand Bargain was a step forward, but there were no firm commitments made.”

GiveDirectly is involved in 13 trials across Kenya, Uganda, Rwanda, Liberia, Malawi, and the Democratic Republic of the Congo, measuring the impact of cash transfers on households and the local economy. This includes the largest basic income evaluation in the world, says the Professor of Political Economy at the University of California at San Diego. The practice of cash transfers in the governments of the aforementioned countries is decades-old, inspiring GiveDirectly and similar organisations to follow suit. Backed up by data collection and internal evaluation structures established through its call centres based in each operating country, GiveDirectly is orchestrating a study of USAID programmes in Rwanda seeking to improve nutrition outcomes, which are focused on longer-term ambitions of economic restructuring in the country. Yet, can these nongovernmental organisations and private actors mitigate the costs of paying for cows, seeds, textbooks, and business training through the micro-financing of billions of dollars in basic services through cash transfers?

Showing the money to those in extreme poverty will also hinder them in the long-term as cash transfers cannot finance the massive infrastructural, health, and education gaps in a village that are oxygenating dire poverty in the first place. The financial flows are also trapped in the grasp of a few price-setting institutions: international development banks, pension funds, and private donors. The stagnant water is in the limited circulation of loans outside of Western markets under the World Bank and international development banks policies; Their loans are mean-tested on the implementation of progressive policies, but also include restrictive criteria for ‘creditworthiness’ by which several African countries are deemed ineligible to borrow on market terms based on GNI measures that are often unsupported by accurate data.

In this increasingly deoxygenated environment, it is no surprise that Chinese foreign direct investments (FDI) are becoming the main source of infrastructure-building in Africa, with China able to charge higher fees on its loans in Africa and import its own workers to implement their projects in comparison to American and European counterparts pursuing natural resource extraction and infrastructure projects across the continent; however, FDI from China comes with strings attached, primarily focused on long-term control of African sovereign, rich natural resources and suppression of domestic employment. A growing Africa willing to take available loans should seek out international FDI strategies that will promote domestic employment and retain their authority over their internal natural resource extraction, to ensure their governance of long-term sustainability and growth in global markets.

One should not react to a mosquito bite by scratching the wound. The stagnant water underlying the Commission’s ambitions for global poverty eradication and breeding its shortsightedness are regressive policies and absent indices to measure the implementation and effectiveness of EU member countries’ official development assistance aid in recipient countries. Rather than project its definitions of human rights and state-based governance abroad namely in former colonies, the Commission must reform and recast its net of foreign development aid in the advancement of recipient-designed and -led implementation programmes. In the new decade, as a first step, the Commission should fund and integrate medical, public policy, and economic research to create accurate indices informing EU development aid cash flows and their socio-economic impacts on recipients and their respective institutions of welfare. Whether to control, eliminate, or eradicate, the Commission faces only one solution to its festering, mortal wound: concerted, informed action.

Mahima Shah Verma is the Editor-in-Chief of The Governance Post. She is a candidate for the Masters of International Affairs at the Hertie School. Her ongoing research and work focus on education and the rights and protection of children in the fields of international law, social and health policy, and peacekeeping and humanitarian action of the African Union and the United Nations. She holds a B.A. in History from the University of Southern California, specialising in oral history and photojournalism of mass violence and genocide in Europe and Central and South Asia during the 20th century.